Join MVA Vietnam to learn about Official Letter 457/CTHN-TTHT 2022 on issuing commercial discount invoices. To understand the innovations in the dispatch so that customers, businesses can be more proactive in the upcoming plans.

Related services:

» Specializing in business investment, sale and transfer, project transfer, investment consulting, business agency.

» Accounting and Auditing Services

» Corporate Law Services

» Real Estate MVA Land

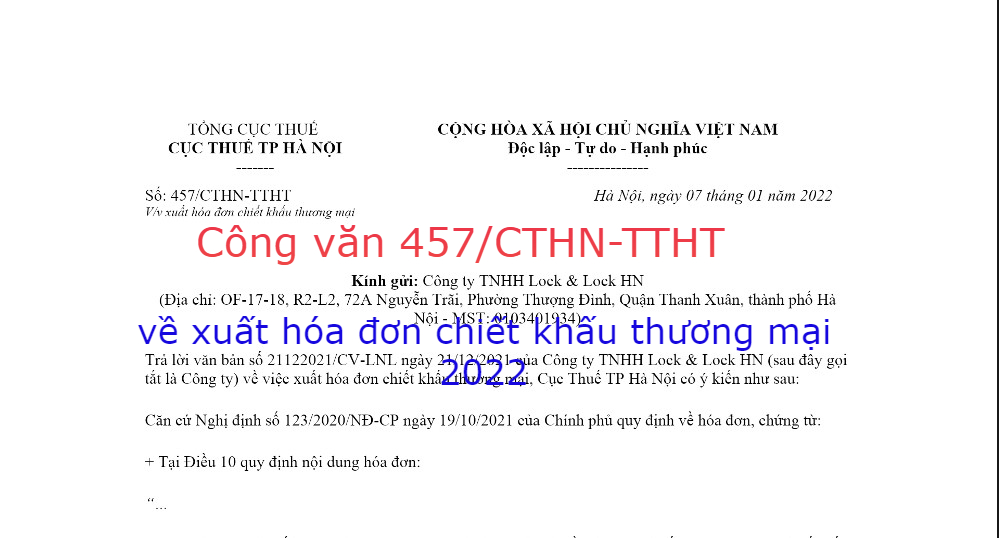

Contents of Official Letter 457/CTHN-TTHT 2022 on issuing commercial discount invoices:

|

GENERAL DEPARTMENT OF TAX |

SOCIALIST REPUBLIC OF VIETNAM |

| No: 457/CTHN-TTHT For/v issue commercial discount invoice |

Hanoi, January 7, 2022 |

Dear: Lock & Lock HN Co., Ltd

(Address: OF-17-18, R2-L2, 72A Nguyen Trai, Thuong Dinh Ward, Thanh Xuan District, Hanoi City – MST: 0103401934)

Responding to the document No. 21122021/CV-LNL dated December 21, 2021 of Lock & Lock HN Co., Ltd (hereinafter referred to as the Company) on the issuance of commercial discount invoices, the Hanoi Tax Department has the intention opinion as follows:

Pursuant to the Government’s Decree No. 123/2020/ND-CP dated October 19, 2021 on invoices and documents:

+ In Article 10, the invoice content:

“…

6. Name, unit of calculation, quantity and unit price of goods and services; into money excluding value added tax, value added tax rate, total value added tax amount according to each tax rate, total value added tax amount, total payment including value tax increase.

…

dd) In case the business establishment applies the form of commercial discount for customers or promotion as prescribed by law, the commercial discount or promotion must be clearly shown on the invoice. The determination of the value-added tax calculation price (into cash excluding value-added tax) in the case of application of commercial discounts for customers or promotions shall comply with the provisions of the law on value-added tax. …”

Pursuant to Circular No. 219/2013/TT-BTC dated December 31, 2013 of the Ministry of Finance guiding the implementation of the Law on VAT and Decree No. 209/2013/ND-CP dated December 18, 2013 of the Government on detailing and guiding the implementation of a number of articles of the Law on VAT:

+ In Clause 22, Article 7 stipulates the taxable price:

“22. Taxable prices for goods and services specified in Clauses 1 to 21 of this Article include surcharges and additional charges in addition to the prices of goods and services to which business establishments are entitled.

In case a business establishment applies the form of commercial discount to customers (if any), the VAT calculation price is the discounted commercial selling price for the customer. In case the commercial discount is based on the quantity and sales of goods or services, the discount amount of the sold goods shall be adjusted on the goods and service sale invoice of the last purchase or period. next. In case the discount amount is made at the end of the sales discount program (period), an adjusted invoice shall be issued with a list of the invoice numbers to be adjusted, the adjusted amount and tax amount. Based on the adjusted invoice, the seller and the buyer declare and adjust the revenue from purchase and sale, output and input taxes…”

Pursuant to the above-cited regulations, in case the Company uses e-invoices according to Decree No. 123/2020/ND-CP of the Government, a commercial discount will be applied to customers buying goods in accordance with the provisions of law. According to the law, the invoice content must comply with the provisions of Point dd, Clause 6, Article 10 of Decree No. 123/2020/ND-CP. In case the commercial discount is based on the quantity and sales of goods or services, the discount amount of the sold goods shall be adjusted on the goods and service sale invoice of the last purchase or period. next; In case the discount amount is made at the end of the sales discount program (period), an adjusted invoice shall be issued with a list of invoice numbers to be adjusted, the adjusted amount and tax amount as prescribed in Clause 1 of this Article. 22 Article 7 Circular No. 219/2013/TT-BTC of the Ministry of Finance.

In the process of implementing tax policy, in case there are still problems, the Company can refer to the guiding documents of the Hanoi Tax Department posted on the website http://hanoi.gdt.gov.vn or contact Contact the Department of Inspection – Inspection No. 1 for assistance in solving.

Hanoi Tax Department notifies Lock & Lock HN Co., Ltdknow.

Receiving place: – As above; – Department of Technical Information 1; – Department of NVDTPC; – Website of the Tax Department; –Save:VT, TTHT(2) |

KT. DEPARTMENT DEPARTMENT Nguyen Tien Truong |

Hopefully with the sharing and analysis of the Official Dispatch on your business, employees can understand the content of the Official Dispatch, the limitations so that businesses and employees can better arrange their projects. determined in the future.

MVA Vietnam – Success Comes From Difference